13 Oct 2025

rotki has had the same subscription price since our founding at the end of 2017. That’s more than seven years without a single price change, through rising costs, rampant inflation, new integrations, countless DeFi upgrades, and the growth of our small team maintaining an ever-expanding codebase.

During that time, the app evolved massively.

We’ve added support for dozens of new protocols and chains, onchain data decoding, new accounting features, reporting exports, analytics, active management of funds and many improvements to the local app itself: all while staying fully privacy-preserving, open source, and independent.

But our pricing never moved. That’s not sustainable anymore.

We don’t sell user data. We don’t take a cut from transactions. We don’t inject analytics or tracking. Our entire income comes from people who choose to support us directly. That’s what keeps rotki independent and what makes it very different from most modern “cloud apps.”

To keep developing at the quality and pace users expect, we’re introducing a new tiered subscription system.

The new structure

- Free - stays exactly as it is today. All core local functionality remains free forever.

- Basic - is now priced at €25/month (VAT included) and replaces today’s “Premium” tier.

- Advanced - for power users with more heavy needs. This tier raises all limits(devices, DB size etc.) and is tailored for people managing more diverse portfolios.

- Custom - For businesses, family offices, high net worth individuals whose needs go beyond the advanced tier. Includes tailored limits, dedicated support, and more.

All current Premium subscribers will automatically move to the Basic tier starting from November 10th, 2025 and onwards. As part of this update, we’re also simplifying subscription periods. All existing plans that renew every 3 or 6 months will automatically switch to monthly billing at the Basic tier price (€25/month, VAT included) starting November 10th, 2025.

If you prefer not to continue, you can cancel your subscription before that date. Otherwise, no action is needed, your next billing cycle will switch to the new plan and price.

Why we made this change

rotki was built with one goal: to give users full control of their financial data without having to share it with third parties or store it in other people’s servers.

That goal doesn’t change but building and maintaining such software isn’t cheap. Far from it.

Over the years:

- Admin expenses, inflation, devops has all become much more expensive.

- Our workload grew as DeFi exploded: hundreds of new chains, thousands of protocols, token standards, and quirks to handle. We are downstream of all these and have to adjust things continuously and respond to dev changes made many times by amateur teams.

- We’ve been running on a shoestring budget for years, kept alive largely by passion and community goodwill.

Until now, rotki’s revenue has mostly come from grants for integrations, followed by donations through campaigns like Gitcoin and Giveth, and lastly from premium subscriptions. The problem is that both grants and donations are unpredictable. They depend on third parties and changing funding cycles. To build rotki sustainably and plan long-term, we need a more stable foundation, and that means making user-supported revenue the main driver of our growth. rotki is not a mass-market app, it’s a precision tool for people who care about control and privacy.

We price accordingly, to build something that lasts.

This update simply aligns pricing with the reality of what it takes to keep rotki alive, reliable, and improving.

We know price increases are never pleasant, but this is what allows us to:

- Continue offering an OSS, self-hosted privacy-preserving app.

- Keep all data processing on your machine: not ours.

- Fund ongoing maintenance and new feature development without having to resort to shady business practices and exploit the data of our users.

- Add extra tools, such as indexers for our premium users which will speed things up and make data retrieval for prices and events faster. A commonly mentioned pain point for rotki as it currently stands

Our commitment to openness, privacy, and user alignment stays absolute.

If you’ve been supporting us, thank you. You are literally the reason rotki exists. If you haven’t yet, or you paused your sub, now is a good moment to rejoin and help us keep building independent, self-hosted software in a world moving toward the cloud.

09 Oct 2024

In an era where data privacy and security are at the forefront of our digital lives, transparency has become a key factor in building trust. For individuals managing cryptocurrency portfolios, trust is not just a preference—it’s a necessity. This is where rotki, an open-source portfolio tracking and management tool, sets itself apart from competitors by emphasizing transparency as a core value.

What Does Open Source Mean?

An open-source project makes its source code public so that any person can see it, alter it, or even go so far as to contribute to the codebase. An important part of being open source means allowing others to build their products on top of yours. For more check the OSI definition. In the context of rotki, this means everything in terms of the inner workings of the software being open to anyone who wants to inspect them. This means that users do not have to take the word of the company for anything; they can inspect the code independently or use independent, third-party reviews by security researchers to ensure there are no hidden vulnerabilities or data-handling practices that might compromise their privacy.

Why Transparency is Important in Crypto Portfolio Management

Cryptocurrency was founded on decentralization and user empowerment. Crypto users usually want tools that enable full control over their money and data. Open source allows complete transparency where no decision-making about your security or information will be hidden from you; everything is in the open for you to see and understand. Transparency is of utmost importance in software like rotki for the following reasons:

- Trust Through Code Inspection: Because it is open source, everybody has the opportunity to inspect said software for its intended workings without any backdoors or hidden security risks. In this case, users of rotki can verify that their financial data will stay on their device and not be sent to third parties. That alone gives peace of mind to the user as their sensitive information is safe.

- No hidden backdoors: Open-source software means removing any threat of hidden backdoors that can leak your data. With closed-sourced software, users are not sure their information will be secure. Even companies that you can trust can fall prey to security breaches. Rotki being open-source by nature makes everything at least visible, and hence there’s little room for doubt about its integrity.

- Community Contributions: The success of any open-source project is dependent on community contributions. Bug reporting, active improvement suggestions, and even code contributions mean rotki is constantly improving. This will keep the software updated, secure, and receptive to the users’ needs. The more eyes look at the code, the faster bugs can be found and fixed, hence rotki gets more bullet-proof with time.

- Innovation through Transparency: Free and open-source software allows any developer to start working on projects based on code that already exists. Using the case of rotki, for example, people can build new features and even completely new tools on top. That means rotki evolves with the community, updating at every turn based on the input and ideas of its users.

- Aligned with Decentralization: Decentralization is central to cryptocurrency, and open-source software aligns with this principle. Rotki’s transparency ensures users aren’t tied to one company. They can access the code, modify it, and develop it independently. This gives users more control and freedom, so they’re not limited by one company’s rules.

Rotki: Example of Open Source Done Right

Rotki goes beyond being a typical portfolio management tool by fully embracing open-source principles to empower its users. Here’s what makes it unique:

- Data Privacy: All your financial data remains on your device. Rotki does not store or process your data on its servers, and this promise can be independently verified by taking a look at its source code.

- Community-driven: Contributions come in from users all over the world. Be it feature requests, bugs, or even writing code, the community drives how rotki evolves.

- Security by Transparency: The basis of security in rotki lies in the very fact that the community can always audit and verify the codebase so no malicious practice goes unnoticed, including data siphoning and unauthorized access.

Try it out here — rotki.com

Key Takeaway

The power of open-source software is in its transparency, and this is invaluable for a crypto portfolio manager like rotki. In an industry built on decentralization and trust, the open-source nature of rotki assures users that their financial data is secure, private, and fully under their control. With the code open to all users, you will have the ability to inspect it, contribute to its improvement, and benefit from the oversight provided by the community at large. With rotki, you will join a community that embodies transparency, innovation, and the user’s empowerment.

If you want more info on rotki:

24 Sep 2024

Building a balanced crypto portfolio is important for managing risk and maximizing potential returns in the volatile world of digital assets. Here’s a step-by-step guide to help you create a diversified and well-rounded crypto portfolio.

1. Understand Your Risk Tolerance

Before diving into any asset, you must define your risk tolerance. Cryptocurrencies are notoriously volatile, so it’s crucial to determine how much risk you’re willing to take. High-risk investors might invest more funds in emerging, high-growth tokens, while conservative investors might focus on more established cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH).

2. Diversify Across Different Types of Assets

A balanced crypto portfolio isn’t just about holding different cryptocurrencies. You should consider including different asset types:

- Large-Cap Cryptocurrencies: These are well-established digital assets with substantial market capitalizations, such as Bitcoin (BTC) and Ethereum (ETH). Due to their scale and widespread adoption, they tend to offer more stability and are generally less volatile compared to smaller, emerging cryptocurrencies.

- Mid-Cap and Small-Cap Cryptocurrencies: These include newer or less established digital assets that have the potential for significant growth. While they can offer substantial returns, they also come with increased risk and volatility compared to larger, more established cryptocurrencies.

- Stablecoins: To reduce volatility in your portfolio, consider including stablecoins like Tether (USDT) or USD Coin (USDC). These assets are pegged to fiat currencies, such as the US dollar, offering stability and minimizing exposure to market fluctuations.

3. Regularly Rebalance Your Portfolio

Cryptocurrency prices can change rapidly, leading to an unbalanced portfolio over time. Regularly review and rebalance your portfolio by adjusting your asset allocations to align with your pre-defined risk tolerance and investment goals.

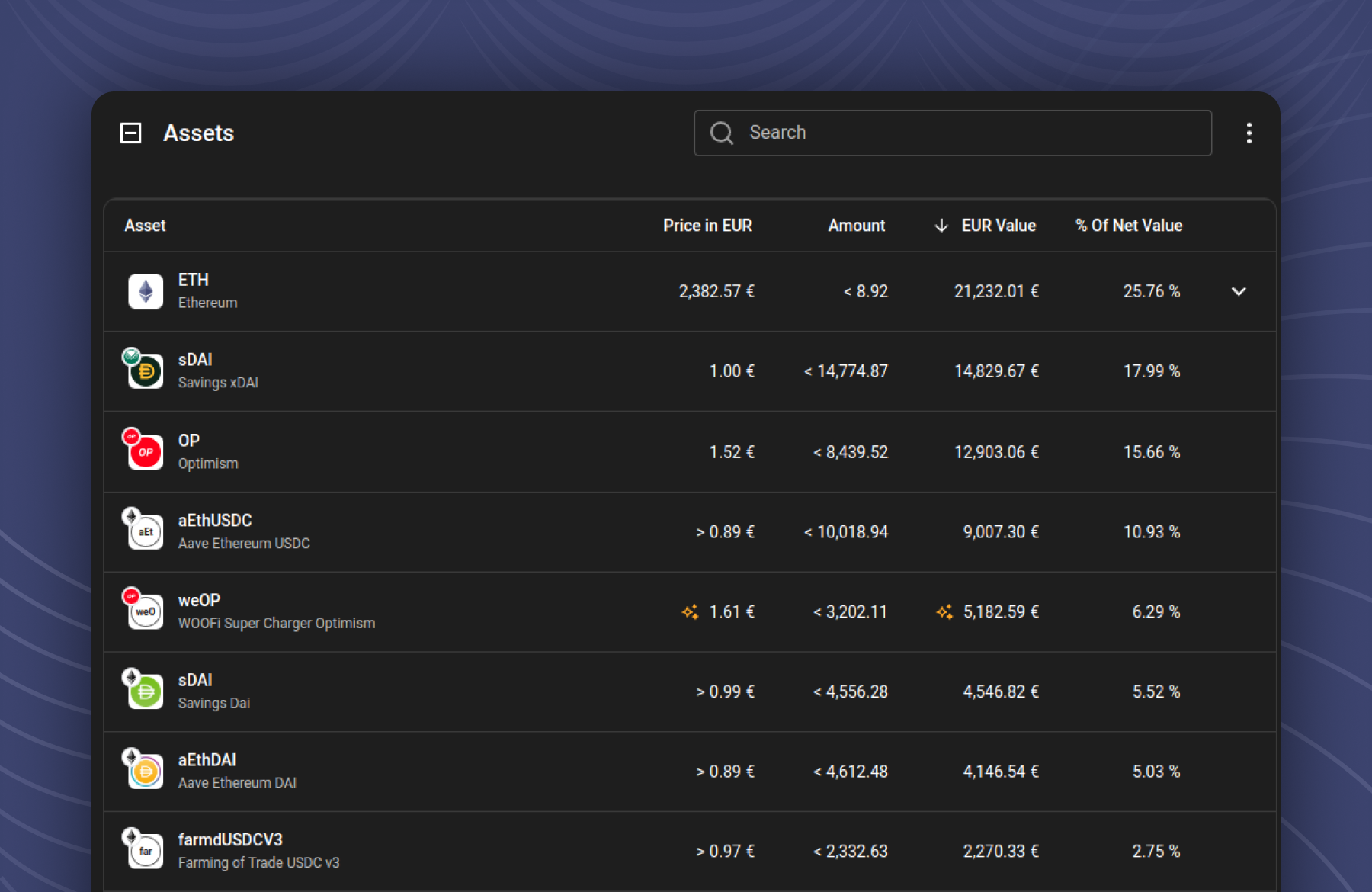

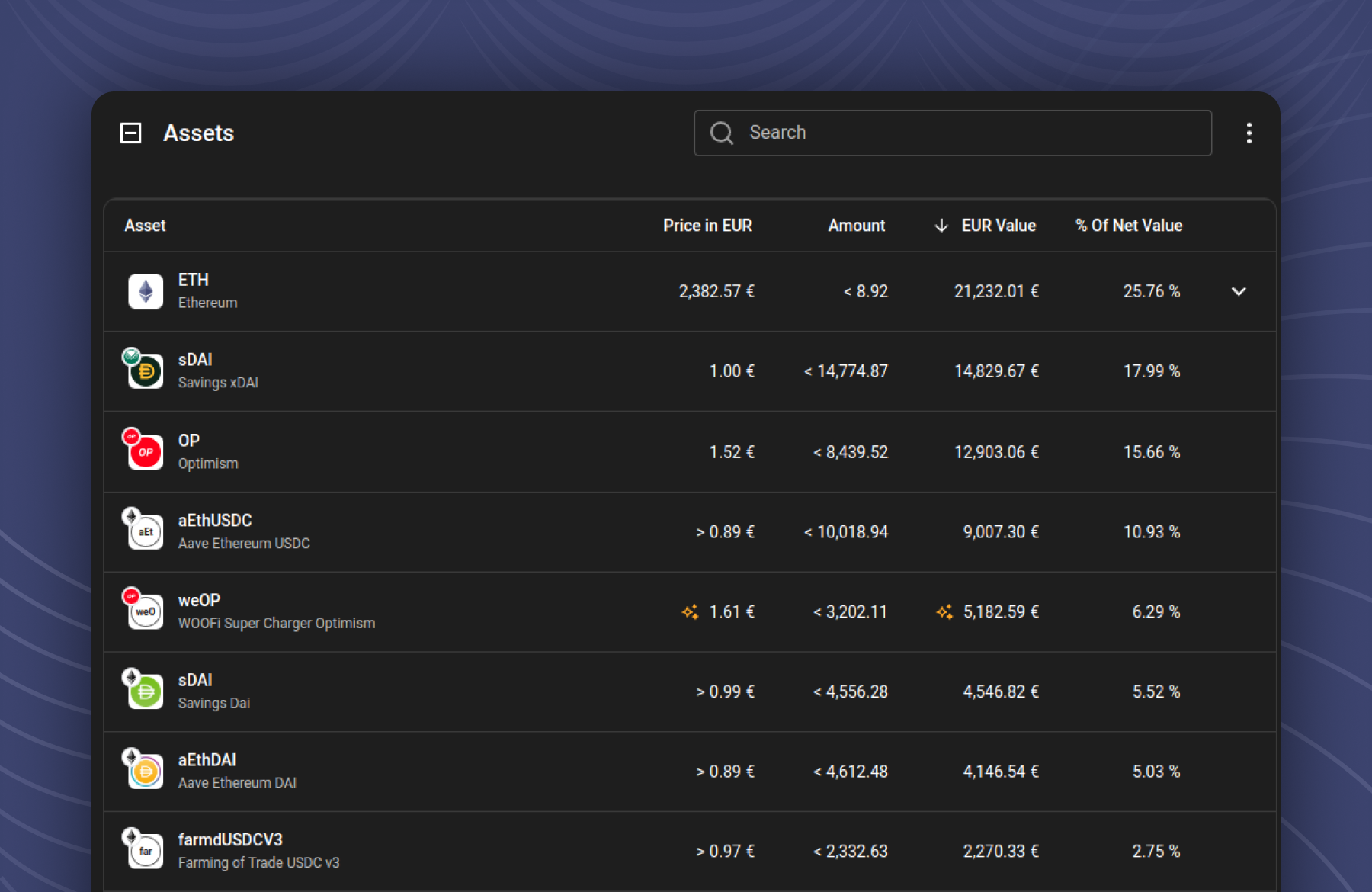

Managing a diverse crypto portfolio can be complex, but tools like rotki make it easier. Rotki is an open-source, privacy-focused portfolio management platform that allows you to track your assets while keeping your data secure. Unlike many other platforms, rotki stores all data locally on your machine, ensuring complete control over your financial information.

Try it out here — rotki.com

The crypto market is constantly evolving. You need to stay updated on market trends, technological developments, and regulatory changes. Being adaptable and informed allows you to make better decisions and adjust your portfolio proactively.

By diversifying across different asset types and regularly rebalancing, you can build a crypto portfolio that balances risk and reward, positioning you for long-term success in the dynamic world of digital assets.

Key Takeaway

A balanced portfolio can mean all the difference in a highly volatile market like the crypto market. You need to make sure that your trading strategy includes balancing out your crypto portfolio to mitigate risks and improve your returns.

If you want more info on rotki: