How to Build a Balanced Crypto Portfolio

24 Sep 2024- 1. Understand Your Risk Tolerance

- 2. Diversify Across Different Types of Assets

- 3. Regularly Rebalance Your Portfolio

- 4. Use Tools Like rotki for Privacy-Focused Management

- 5. Stay Informed and Adapt

- Key Takeaway

Building a balanced crypto portfolio is important for managing risk and maximizing potential returns in the volatile world of digital assets. Here’s a step-by-step guide to help you create a diversified and well-rounded crypto portfolio.

1. Understand Your Risk Tolerance

Before diving into any asset, you must define your risk tolerance. Cryptocurrencies are notoriously volatile, so it’s crucial to determine how much risk you’re willing to take. High-risk investors might invest more funds in emerging, high-growth tokens, while conservative investors might focus on more established cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH).

2. Diversify Across Different Types of Assets

A balanced crypto portfolio isn’t just about holding different cryptocurrencies. You should consider including different asset types:

- Large-Cap Cryptocurrencies: These are well-established digital assets with substantial market capitalizations, such as Bitcoin (BTC) and Ethereum (ETH). Due to their scale and widespread adoption, they tend to offer more stability and are generally less volatile compared to smaller, emerging cryptocurrencies.

- Mid-Cap and Small-Cap Cryptocurrencies: These include newer or less established digital assets that have the potential for significant growth. While they can offer substantial returns, they also come with increased risk and volatility compared to larger, more established cryptocurrencies.

- Stablecoins: To reduce volatility in your portfolio, consider including stablecoins like Tether (USDT) or USD Coin (USDC). These assets are pegged to fiat currencies, such as the US dollar, offering stability and minimizing exposure to market fluctuations.

3. Regularly Rebalance Your Portfolio

Cryptocurrency prices can change rapidly, leading to an unbalanced portfolio over time. Regularly review and rebalance your portfolio by adjusting your asset allocations to align with your pre-defined risk tolerance and investment goals.

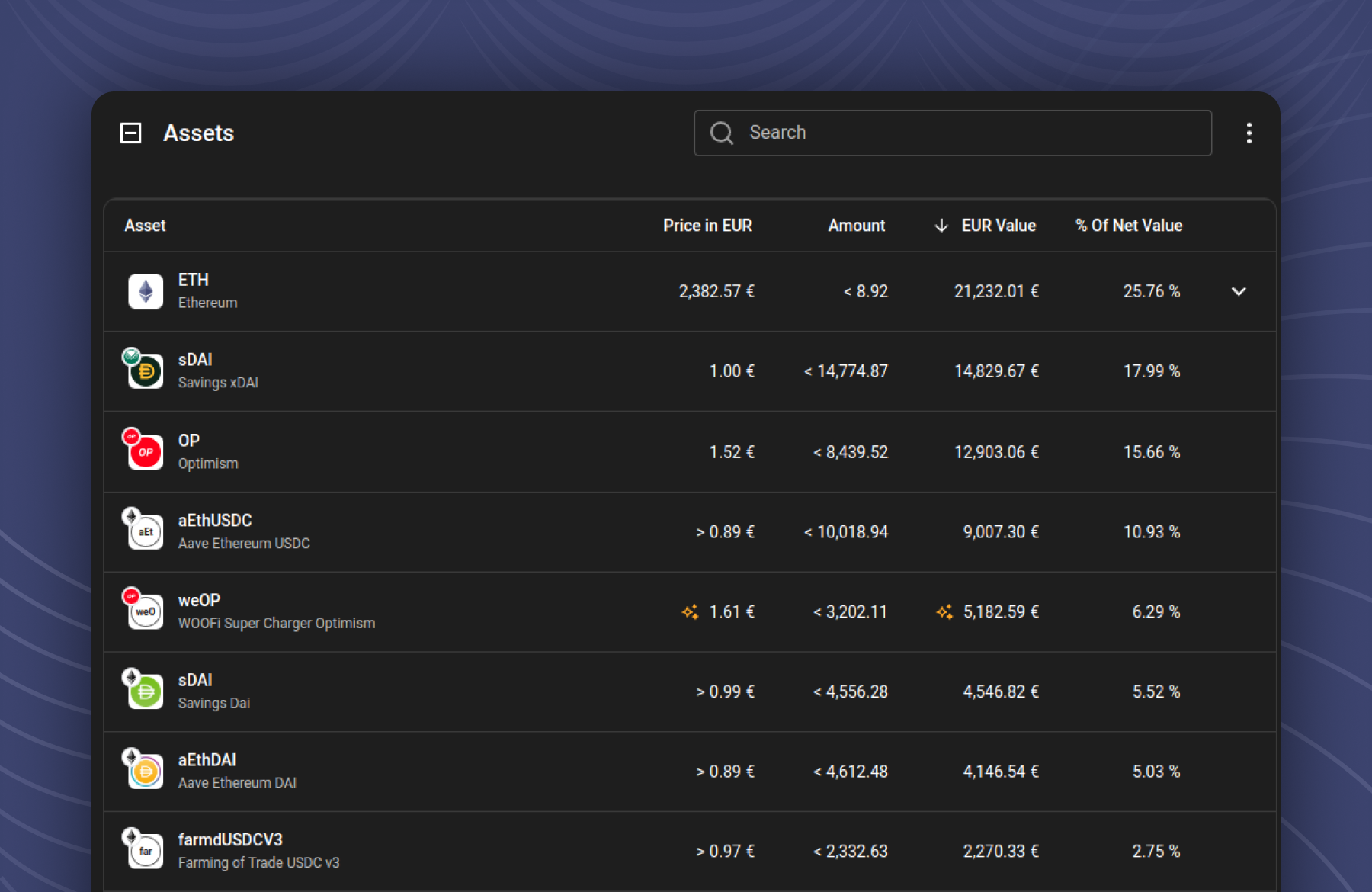

4. Use Tools Like rotki for Privacy-Focused Management

Managing a diverse crypto portfolio can be complex, but tools like rotki make it easier. Rotki is an open-source, privacy-focused portfolio management platform that allows you to track your assets while keeping your data secure. Unlike many other platforms, rotki stores all data locally on your machine, ensuring complete control over your financial information.

Try it out here — rotki.com

5. Stay Informed and Adapt

The crypto market is constantly evolving. You need to stay updated on market trends, technological developments, and regulatory changes. Being adaptable and informed allows you to make better decisions and adjust your portfolio proactively.

By diversifying across different asset types and regularly rebalancing, you can build a crypto portfolio that balances risk and reward, positioning you for long-term success in the dynamic world of digital assets.

Key Takeaway

A balanced portfolio can mean all the difference in a highly volatile market like the crypto market. You need to make sure that your trading strategy includes balancing out your crypto portfolio to mitigate risks and improve your returns.

If you want more info on rotki:

- Try out rotki’s latest release

- Buy premium, unlock all features and support our development.

- Check out our Github repo and follow us in Twitter.

- Chat with us and other users of Rotki in Discord